Medical Real Estate Continues to Rise in Popularity

Amid volatile economic conditions resulting from the impacts of COVID-19, medical real estate remains a popular choice for investors as they search for stability and higher-yielding opportunities in an economy with asymmetrical risk factors.

According to the Office of the Actuary at CMS, national health spending growth will continue to outpace GDP growth through the year 2027, reaching $6 Trillion with an average annual rate of 5.5%. This growth combined with a measurable shift away from hospital-based care and an aging population continue to fuel the demand for more the development of more healthcare facilities.

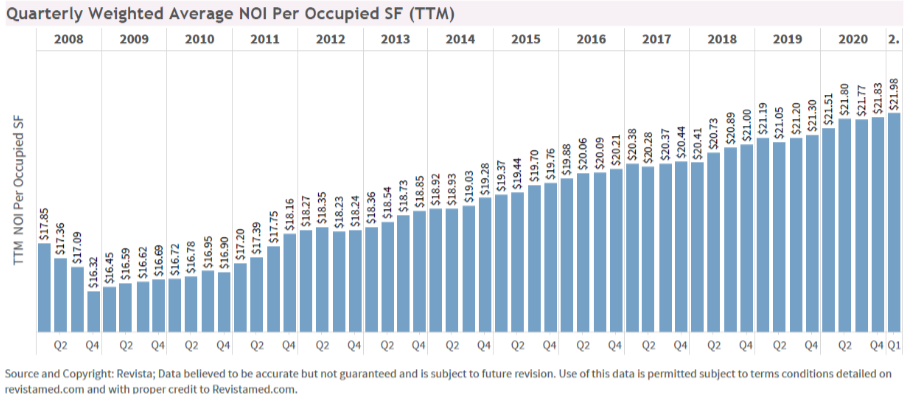

In addition, retailers such as CVS and Rite Aid are transforming their facilities to offer healthcare to populations in rural and suburban markets that traditionally have much fewer options for treatment. Nearly 80% of private equity, commercial real estate, and retail healthcare respondents believe medical retail i.e., “MedTail”, will increase in the coming year, and that COVID-19 bolstered the outlook. Compared to an average occupancy ranging between 82.1% to 85.8% in the non-medical office sector, medical offices occupancy re as very stable between 91.4% and 92.6%. This has contributed to continued Net Operating Income (NOI) growth across the sector.

As the impacts of the digital transformation continue to alter the commercial real estate landscape and property sectors such as retail and non-medical offices evolve to meet the challenges of the future, medical real estate remains a strong contender for investors searching for stability and growth in an economy that remains highly unpredictable.